It's an ideal vision for having less worry about the future and live your life balance. Flexi Link Amanah Syariah provide a solution of life protection gap and give sum assured which derived from the collection of funds from all participants (Tabarru' contribution) in the case of death during the period of insurance.

Coverage Highlights

Provision

- Age of participants: 30 days – 65 years

- Payment period contribution: Flexible, starting from 5 years

- Minimum annual contribution: IDR 1,800,000 Currency: Rupiah

Surplus Underwriting

Participants entitled to obtain Surplus Underwriting as follows:

- 60% for Policyholders

- 20% for Insurance Company

- 20% stored in Tabarru' Fund

Flexibility

In accordance with the provisions written in the policy, you are free to:

- Free to determine the benefits of insurance, starting 5 times from annual contribution

- Free to make changes of benefit which suitable to your protection plan

- Free to determine the nominal deposit of contribution

- Free to determine the frequency of deposit contributions: annual, semi-annual, quarterly, or monthly

- Leave contribution (contribution holiday)

- Free to add investment through non-scheduled contribution

- Free to withdraw some funds from the investment value

- Optimisation of return of investment with the transfer of funds (fund switching)

Investment Fund Options

.

Maximum of Life Protection

- Flexi Link Amanah Syariah provides life protection up to 100 years of age

- Agreement (called as 'Akad') which used in Flexi Link Amanah Syariah are Akad Tabarru’ and Akad Wakalah bil Ujrah

- Flexi Link Amanah Syariah provides benefit to appointed beneficiaries in the amount of sum assured plus accumulated investment return.

- If the participant terminates the contract, the accumulated investment return will be given to appointed beneficiaries

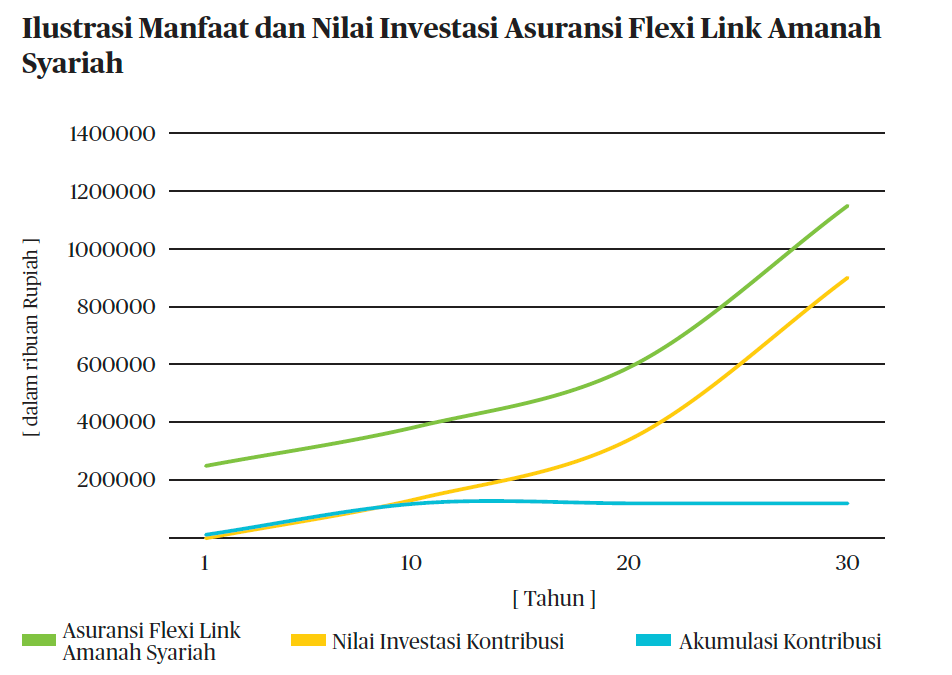

Benefits Scenario

Here is an illustrative sample of benefits and investment return for 30 years.

Mr. A, 30 years old, invests in 10 years, IDR 12,000,000 each year, with sum assured of IDR 250,000,000

|

Number of Years |

Age |

Accumulation of Contribution |

Investment Return |

Benefits of Sum Assured |

|

1 |

30 |

12,000 |

1,763 |

251,763 |

|

5 |

34 |

60,000 |

38,266 |

288,266 |

|

10 |

39 |

120,000 |

138,084 |

388,084 |

|

20 |

49 |

120,000 |

349,060 |

599,060 |

|

30 |

59 |

120,000 |

900,743 |

1,150,743 |

- Formated on thousand Rupiah

- Assumption of 10.5% return on investment

- Without any additional rider

Illsutration Explanation

- If there is a risk of death, participant will obtain benefit that consist of sum assured + investment return

- If Mr.A (on the illustration above) has passed away on 59 years old, therefore:

- Appointed beneficiaries will receive amount of IDR 1,150,743,000

This illustration is only an approximate picture of the investment performance of the selected types of investment funds and is not a guarantee of investment performance. Unit-linked products will provide optimal investment returns when the fund is invested in accordance with the terms, conditions and time frame which has been agreed before. Policy cancellation or early withdrawing funds will affect the result of the development of investment and lead to suboptimal investment results.

Product Mechanism and Fees

- Policy fee IDR 30,000/month will be charged each month starting from 1st month onwards during the validity period of insurance coverage

- Investment management fee is between 1%-3% per year, depends on the selected investment funds. These costs have been factored into the price of the unit

- Risk management fee of 50% (fifty percent) of risk contribution donated every month since the start date Insurance Protection

- All target contribution and scheduled top up contribution will be allocated into the unit using a Unit Price prevailing at that time

- The price of unit consists of single unit price, and can be changed from time to time depending on investment performance

- Administrative cost and contribution risk charged from the price of unit per month

- The price of unit is calculated daily and can be access through the website or Bisnis Indonesia, Investor Daily, and Kontan newspaper

- Free for withdrawal of some investment value for the first two times in one year. Subsequent withdrawals cost IDR 50,000.

- Free for investment value surrender

- The amount of risk contribution is determined by age and gender of the insured and also the amount of sum assured

- The contribution includes the costs of transaction, as risk contribution, wakalah fee (Ujrah), etc.

- Ujrah will be charged from the amount of contribution target as follows:

Information presented is not intended to be binding. Please always refer to terms and conditions in the Policy.

Interested in this Chubb policy?

Have a question or need more information? Contact us to find out how we can help you get covered against potential risks