Coverage Highlights

Optimal Investment

- Platinum Link Insurance allocates 100% of your annual premium deposit to the investment participation unit

- There is no difference beween the unit selling price and the unit purchase price (bid offer spread)

- This insurance offers the flexibility of adding fund to the investment unit

- Free fund switching up to twice a year

Maximum Life Protection

The Platinum Link Insurance provides a lifetime protection up to the age of 100 years and will provide death benefits to beneficiaries in the amount of 100% of the Sum Insured plus your Investment Value. There is another additional benefit in the amount of 100% of the Sum Insured* in the event of the insured’s death due to accident. This additional benefit can be enjoyed until the insured reaches the age limit of 60 years. In addition, there are other protection benefits which can be added to the Platinum Link Insurance, such as:

- Additional Protection of Critical Illness.

- The protection is paid in the event of the insured’s death or the insured has become totally and permanently disabled due to accident

- Daily benefits in the event the insured is hospitalized due to illness or accident

- Protection for your continued investment if you/your spouse is diagnosed with a critical illness, suffering from premanent disablility, or dies. Chubb Life will continue the premium payment until you/your spouse turns 65.

*) The maximum additional benefits in the event of the Insured’s death due to accident is IDR 2,000,000,000.

Product Provisions

- Age of the Insured: 30 days – 65 years old

- Premium Payment Period: Maximum up to 99 years old

- Minimum premium amount: IDR 24,000,000

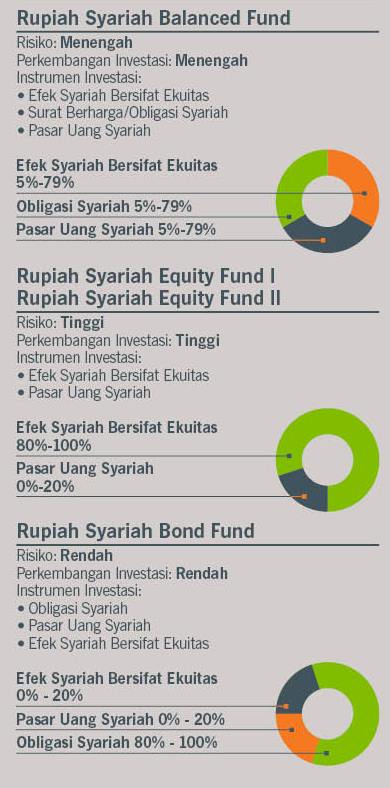

Investment Fund Options

Information presented is not intended to be binding. Please always refer to terms and conditions in the policy.

Interested in this Chubb policy?

Have a question or need more information? Contact us to find out how we can help you get covered against potential risks