Helping business owners navigate the changing duty of care landscape

Payments for employees following hospitalisation

Financial support for businesses to cover related COVID-19 expenses

Helping business owners navigate the changing duty of care landscape

Payments for employees following hospitalisation

Financial support for businesses to cover related COVID-19 expenses

The rise of the COVID-19 pandemic has changed how we live and work. It has placed untold pressure on the financial and human resources for businesses, both large and small. To help businesses and employees, our COVID-19 insurance programme provides the financial support they need to recover.

How does the Chubb Recovery Programme work?

How does the Chubb Recovery Programme work?

For employees and businesses affected by COVID-19, additional financial support during recovery can help the healing process. By taking steps to reduce financial anxiety for their employees, business leaders can reinforce their duty of care commitments and support recovery. Our COVID-19 insurance programme responds as soon as an employee is hospitalised with the illness.

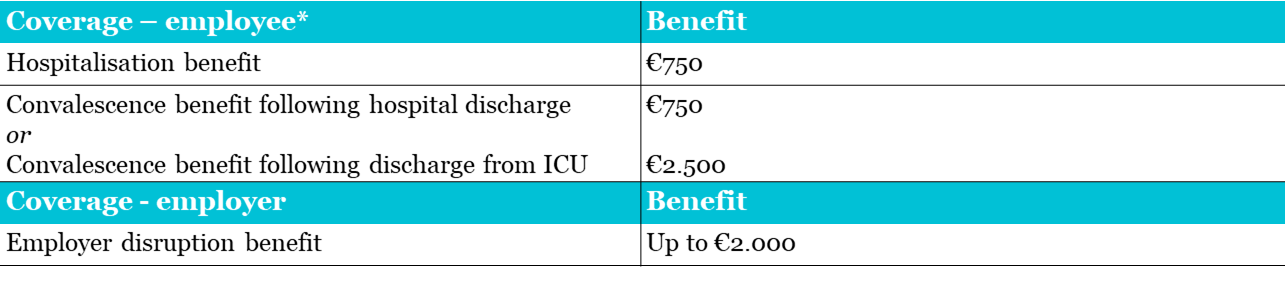

Benefits for employees and businesses

- Adjusting to a new normal

Helping business owners navigate the changing duty of care landscape with benefits designed to respond to the COVID-19 pandemic - Support following hospitalisation

Payments for employees following hospitalisation to ease the financial pressure of healing - Recovering from reinfection

No previous medical exclusions, meaning employees are covered for new COVID-19 infections as well as reinfections

- Protecting employees everywhere

Employees are covered whether they are working remotely from home or at their usual place of work - Flexible lump sum payments

Financial support for employees to help cover childcare costs, alternative transportation and wellness activities - Help for businesses

Payments to help cover expenses such as premises deep clean, recruitment costs and delivery of equipment to home-based employees

*Payments for employee claims are made via the employer.

Frequently Asked Questions

How do I arrange cover?

Cover is available through a broker as a stand-alone product

What is the policy duration?

The coverage period is 3 months following an initial 14 day waiting period

Is there an age limit?

The target group is the working population. There is no upper age limit

Are there any pre-existing medical exclusions?

There are no pre-existing medical exclusions and the application process is streamlined with no need for medical questionnaires or screening

How are claims handled?

Claims are handled through the Chubb Claims Portal, enabling 24/7 notification and swift payment. Payments for employee claims are made via the employer.

Additional Information

Get in touch with us

Contact your local Chubb A&H underwriter for more information and to arrange coverage.