Today's Chubb is a leading global insurer serving customers from the largest multinational companies to individuals and families around the world. The company took its present form in 2016 when ACE Limited acquired the Chubb Corporation, creating the world’s largest publicly traded property and casualty insurance company. Now operating under the renowned Chubb name, both companies brought with them a rich history as leaders and innovators in the industry.

The Chubb Corporation

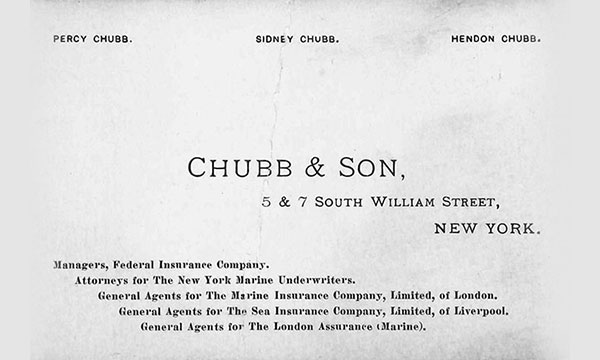

The origins of the Chubb Corporation date back to 1882 when Thomas Caldecot Chubb and his son Percy opened their marine underwriting business in the seaport district of New York City. Having collected $1,000 from each of 100 prominent merchants to start their venture, they focused initially on insuring ships and cargoes.

The Chubbs were adept at turning risk into success, often by helping their policyholders prevent disasters before they occurred. By the turn of the century, Chubb had established strong relationships with the insurance agents and brokers who placed their clients’ business with Chubb underwriters.

Chubb & Son did not value size in itself but regarded it as a measure of what had been achieved. Upon the Company's 75th anniversary in 1957, Hendon Chubb — who had joined his older brother Percy in the firm in 1895 — noted, "I think there is perhaps a tendency in American business to overemphasize mere size, whereas to me it should be a by-product of a job well done."

ACE Limited

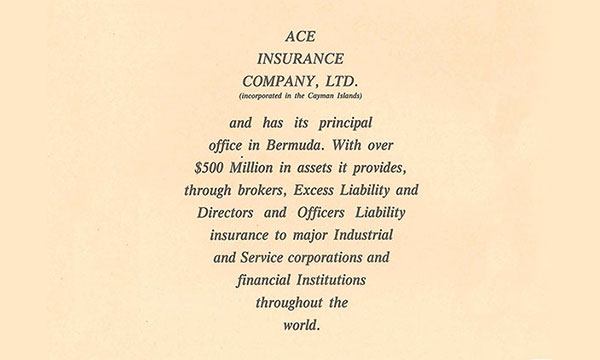

ACE Limited was established in 1985 in response to an availability crisis in the U.S. insurance marketplace for excess liability and directors and officers insurance coverage. Recognizing the need, a handful of forward-thinking pioneers helped form a consortium and pool the capital to create a new kind of insurance company. Those founding sponsors constituted an impressive list of 34 blue-chip companies from a broad range of industries, including health care, pharmaceuticals, manufacturing, transportation, utilities, oil and gas, banking and the automotive industry.

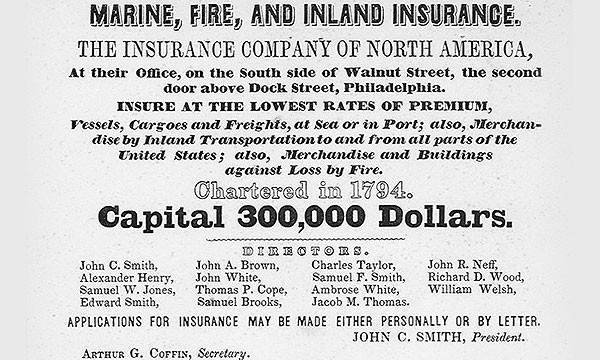

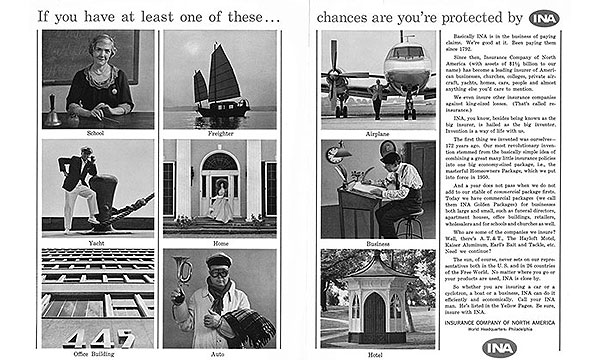

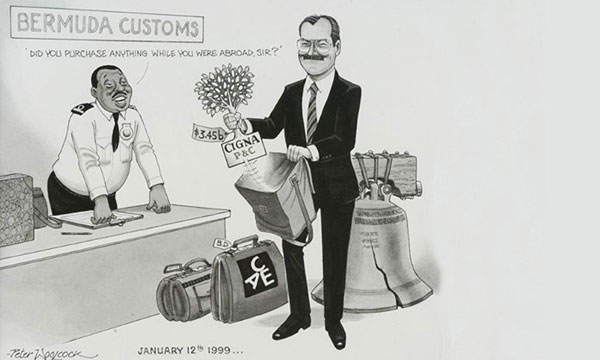

From its inception through the 1990s, ACE grew rapidly through product diversification, strategic partnerships and acquisition. A true turning point for ACE was its 1999 acquisition of Cigna Corporation’s international and domestic property and casualty business, the Insurance Company of North America (INA). The acquisition gave ACE an instant global network and simultaneously transferred INA’s 200-year history to the company.

In the following decade and beyond, ACE progressed on its path of growth and international expansion organically and via strategic acquisition. During that time, ACE fostered its reputation as a superior underwriting company that delivered exceptional service through an unparalleled global network.

Timeline

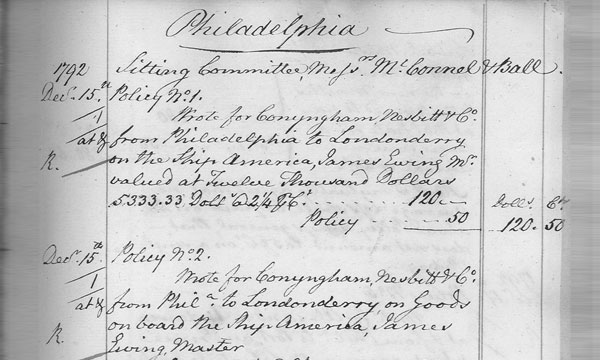

1792

ACE

Investors meet at Independence Hall in Philadelphia to organize the Insurance Company of North America.

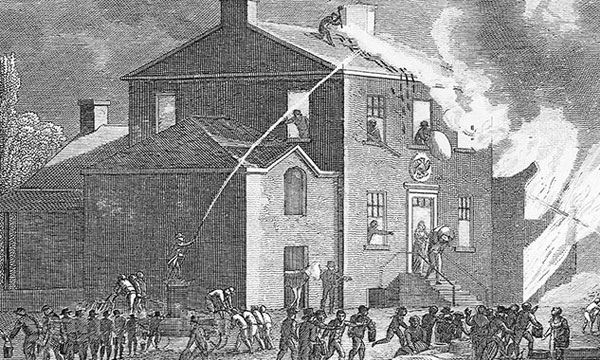

1794

ACE

INA enters fire insurance and is the first U.S. insurer to cover the contents of a house from fire.

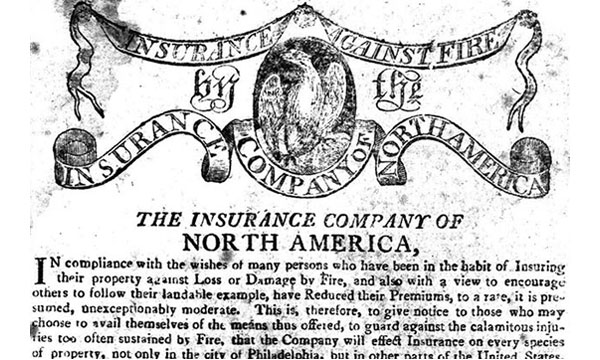

1808

ACE

INA appoints fire insurance agents on the U.S. frontier and launches its first advertising campaign.

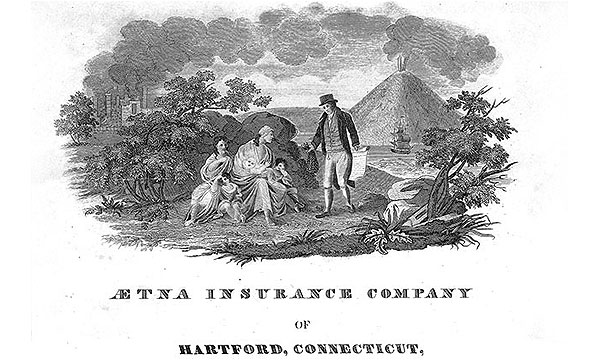

1821

Predecessor

Our predecessor fire insurer Aetna Insurance Company becomes the first U.S. insurer to enter Canada.

1837

Chubb

Thomas Caldecot Chubb is born in London.

1837

Predecessor

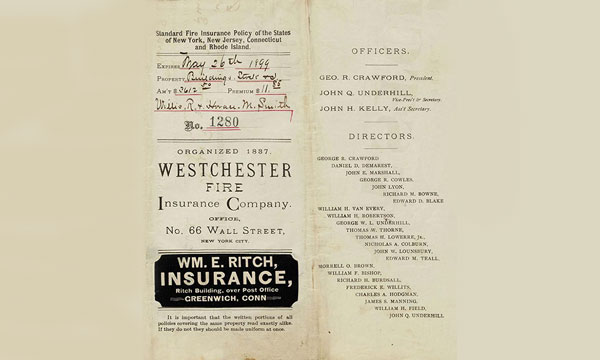

Westchester County Mutual Insurance Company is organized in New Rochelle, NY, the earliest predecessor of our Westchester unit today.

1848

ACE

INA appoints an agent in San Francisco as the California Gold Rush begins. Premiums are sent to the home office in the form of gold dust.

1857

Chubb

Thomas Caldecot Chubb's son Percy Chubb is born in Australia.

1868

Chubb

After relocating to San Francisco, Thomas Chubb lists his new occupation as marine insurance.

1882

Chubb

Thomas and Percy Chubb set up Chubb & Son in New York City.

1887

ACE

INA appoints agents in London, Vienna, and Buenos Aires, the beginning of our Overseas General business today.

1887

Predecessor

Flour mills organize Pennsylvania Millers Mutual Fire Insurance Company, known as Penn Millers today.

1897

ACE

INA becomes the first U.S. insurer to appoint an agent in China.

1901

Chubb

Percy Chubb organizes the Federal Insurance Company in New Jersey. They write marine insurance and expand into fire two years later.

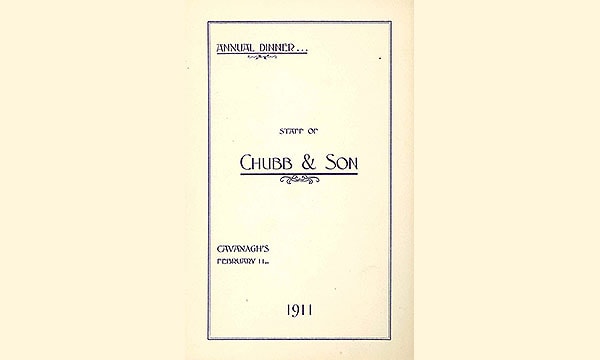

1911

Chubb

The Chubb & Son reins are passed onto Hendon Chubb, Percy Chubb's younger brother.

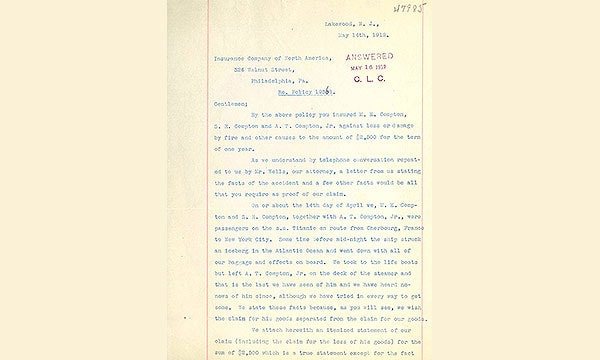

1912

ACE

Three of our predecessor insurance companies (Aetna, Federal, INA) suffer losses from the sinking of the Titanic.

1913

Predecessor

Lloyds of Minneapolis (later Great Northern Insurance Company) begins offering auto liability insurance; it is acquired by Chubb in 1960.

1919

Predecessor

The Hail Audit and Statistical Bureau is formed, leading to the Rain and Hail Insurance Bureau five years later.

1921

Chubb

Chubb acquires control of U.S. Guarantee Company, transforming it from a fidelity and surety company to a general casualty insurer.

1928

Chubb

Chubb & Son opens its first branch outside the U.S. in Montreal, Canada.

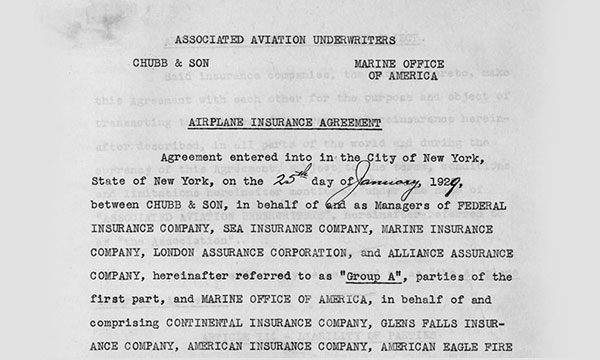

1929

Chubb

Chubb & Son begin underwriting aviation risk.

1939

Predecessor

Insurance agent W. Clement Stone incorporates the Combined Mutual Casualty Company in Illinois, predecessor insurer of Combined Insurance today.

1950

ACE

INA invents the definitive multiple-line homeowners policy.

1955

Predecessor

Pacific Employers Group creates a claims unit called the Employers Self-Insurance Services (ESIS).

1956

Chubb

Chubb forms a personal lines department. It also installs the company's first computer, the IBM 705.

1965

ACE

INA debuts on the New York Stock Exchange. That year it acquires the Pacific Employers Group.

1967

Chubb

The Chubb Corporation is formed. That year, Chubb acquires the Pacific Indemnity Companies.

1976

Chubb

Chubb responds to several years of business challenges by developing its successful focus on select markets, specialties, and—in personal lines—explicitly serving the high net worth client.

1980

ACE

INA insures the Olympic Winter Games in Lake Placid, NY.

1982

ACE

INA Corporation and the Connecticut General Corporation complete a merger to create CIGNA Corporation.

1982

Chubb

E.T. the Extra Terrestrial is released with Chubb Custom Market underwriting the production of the film.

1984

Predecessor

Marsh President Robert Clements foresees a potential excess liability crisis and has an idea to fill the void: American Casualty Excess - ACE.

1984

Chubb

Chubb is listed on the New York Stock Exchange.

1985

ACE

American Casualty Excess Insurance Company Ltd. and parent ACE Limited form.

1986

Chubb

Chubb launches the famed Masterpiece personal lines policy, becoming the company's definitive high net worth product.

1990

Chubb

Chubb begins additional overseas expansion.

1993

ACE

ACE goes public on the New York Stock Exchange.

1996

ACE

ACE acquires the first of its Lloyd's syndicate managing agencies and acquires Tempest Re, our major global reinsurer.

1999

ACE

ACE acquires CIGNA P&C for $3.45 billion, thus entering 50 countries and transforming its business from specialty catastrophic risk to diversified property and casualty.

2001

ACE

Evan Greenberg joins ACE.

2004

ACE

Evan Greenberg named Chief Executive Officer of ACE.

2012

Chubb

Chubb claims service shines after Superstorm Sandy, settling the largest number of claims in company history.

2016

Chubb

ACE and Chubb become one and adopt the Chubb name.

2017

Chubb

Chubb celebrates 225 years of underwriting through the birth of our oldest company in 1792.