Some risks can create losses so great that they are not insurable in the private insurance market without substantial government support, including catastrophic terrorism, nuclear accidents and pandemics. These catastrophic events can cause massive economic disruption as governments struggle, as they have in response to COVID–19, to provide effective and timely assistance through programs cobbled together after the disaster has struck. Not surprisingly, these ad hoc programs can lead to inefficiencies, substantial delay and uncertainty, as well as real and perceived unfairness in aid distribution.

Overview

There is a better way. Chubb believes that a public–private partnership program can be implemented before the next pandemic that recognizes the differing needs of small and large businesses and will provide:

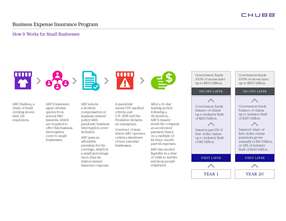

- Affordability and certainty for small businesses about the amount of financial support available if a pandemic shuts down the economy.

- Quick and efficient payment of a pre–determined sum to small businesses without the need to adjudicate individual claims.

- An incentive to keep people employed, rather than relying on unemployment relief.

- A market–oriented program for larger businesses intended to support and stimulate the private market for pandemic coverage.

- Insurance industry risk-sharing with the federal government, together with a better understanding of pandemic risk, risk mitigation and preparedness, increasing over time.

These are key components of Chubb’s Pandemic Business Interruption Program. The Program has two elements: a program for small businesses that provides an immediate cash infusion when a pandemic is declared and a separate voluntary program for medium and large businesses with losses paid through the existing industry claims adjudication process. Both depend on the federal government assuming a substantial percentage of the risk, through direct U.S. Treasury funding to insurers for the small business program, and through a newly created government–run reinsurance entity for medium and large business losses.

Read the Chubb Pandemic Business Interruption Program

Learn More About the Chubb Program

The Chubb Program in the News

Chubb wants U.S. to offer businesses pandemic cover, with insurers taking some risk, Reuters, 7/8/2020

Chubb Urges U.S. and Insurers to Team Up for Future Pandemic Costs, Bloomberg, 7/8/2020

U.S. insurance industry rift deepens over pandemic cover, Financial Times, 7/8/2020