Chubb’s Private Company Risk Survey shows that more than one in four of the private companies surveyed experienced a Directors & Officers (D&O) liability loss in the past three years — and 96 percent of those companies were impacted financially. Such losses impact companies of all sizes and industries, ranging from healthcare organizations, to manufacturers, to retailers and more.

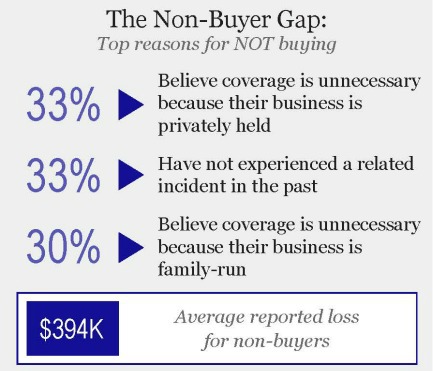

Despite the frequency and impact of these events, many private companies have not purchased D&O insurance to help manage their risks. Why? Because non-buyers mistakenly believe the coverage is unnecessary, either because they are privately held or family run.

This belief stems from the misconception that most suits or fines are brought by shareholders, which is commonly the case in the more highly publicized suits brought against public companies. But for private companies, suits from customers, vendors/suppliers and other third parties most prevalently lead to losses. Even more alarming, when a non-buyer does experience a D&O loss, the average cost is nearly $400,000 — a sum that can have a serious and potentially devastating impact on an organization’s balance sheet.

Based on information collected by Chadwick Martin Bailey from 1,012 decision-makers for firms’ management and professional liability risk management and insurance coverage for businesses within select industries in the U.S. and Canada, and analysis by Chadwick Martin Bailey of that information.

Learn More

Download our full D&O liability insurance and risk management infographic now. Additional findings relating to Cyber, EPL and Crime coverages will be released later this year. Sign up to be among the first to receive these.