With Whole Life Extra, you can get lifetime protection and cash benefit paid yearly since the end of the first policy year and increased year by year from insured age 61 to 89 years old. It is not only for your retirement fund, but also family protection if unexpected incident happens.

Highlighted Benefits

- Worthwhile with annual cash payouts (% of sum assured)

- 2.25% paid at the end of the first policy year until insured age 60

- 10% paid at the end of policy year where insured age reaches 61, and increased 0.5% every year until insured age 89, which is equal to 24%, or 493% of total cash benefit

- Valuable with minimum 2% of annual interest rate if save the cash payouts with the company

- Guaranteed 100% of sum assured paid at maturity, if insured is still alive

- Worry free with death benefit, which can be passed on to the loved ones

- Flexible with premium payment period options, either 10 or 15 years

- At ease with extensive coverage by attaching riders*

- Tax deductible for premium payment according to conditions as announced by Revenue Department** (Learn more)

Life Coverage Benefit

In case of death, the company will pay 200% of sum assured, cash value amount of the policy, or total paid premium amount of basic plan, whichever is higher to beneficiaries.

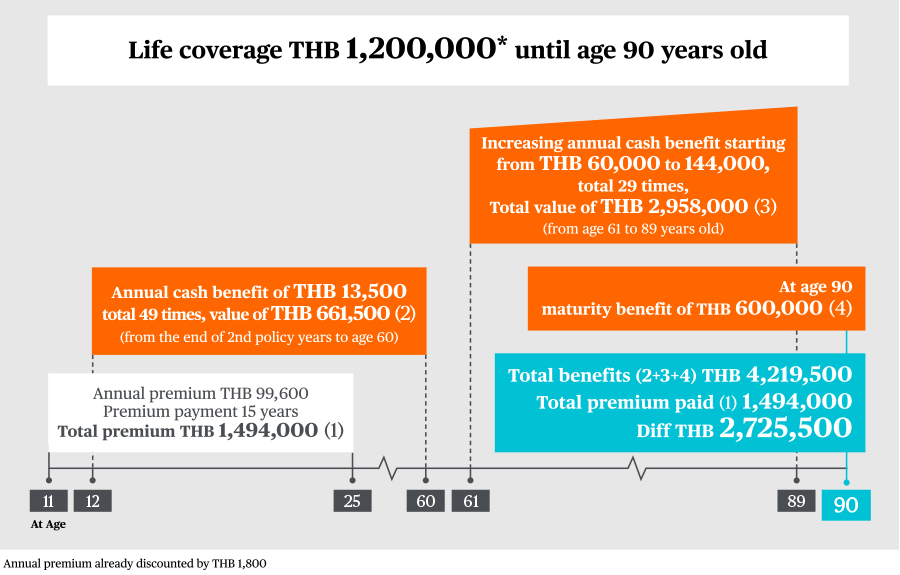

Sample of Benefit: payment period 15 years

- Life coverage THB 1,200,000*

- Total premium paid THB 1,494,000 (1)

- Annual premium THB 99,600

- Premium payment period 15 years

- Annual cash benefit at the end of policy year of THB 13,500 paid 49 times, or total amount of THB 661,500 (2)

- Annual cash benefit paid at the end of policy year where insured age reach 61 until 89 years old, total amount of THB 2,958,000 (3)

- From age 61 cash benefit starting at THB 60,000 and the benefit being increased every end of policy year

- Maximum cash benefit of THB 144,000 at 89 years old

- Maturity benefit paid at the end of policy year where insured age reach 90 THB 600,000 (4)

- Diff between premium paid and maximum benefit (2+3+4)-(1) THB 2,725,500

*In case of death before age 90, the company will pay the amount of life coverage THB 1,200,000 or cash surrender value or paid premium deducted by all cash coupons which have already received from policy benefit, depending whichever is the highest

Example of Premium Discount

| Sum Assured (THB) | Discount (THB) |

| 300,000 | 300 |

| 600,000 | 1,800 |

| 1,000,000 | 5,000 |

Preliminary Underwriting Guideline

- Insured aged:

- 31 days - 50 years old for premium payment period of 10 years

- 11 - 45 years old for premium payment period of 15 years

- Minimum sum assured: THB 100,000

- Attach with specific riders according to underwriting guideline

Let us help you with your life goals

Contact us to find out how we can help you achieve your insurance needs