With the price of rare whisky on the rise, connoisseurs and collectors are turning to scotch (Scottish whisky) and bourbon (Irish or Kentucky whiskey) as the newest liquid investment. While not every bottle will bring record profits – like the 1926 Macallan whisky, sold at Christie’s in London for US$1,528,800 in 2018 – collecting whisky can be a fun and potentially profitable endeavour.

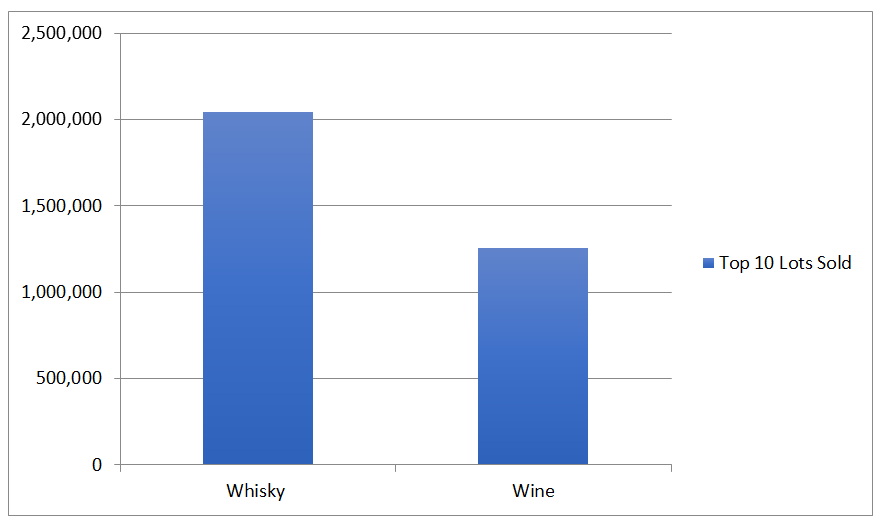

Rare whisky sales top that of wine

In 2018, US$3,300,000 of Christie’s sales came from ten high value lots involving alcohol. Of those ten, four of the sales totalling US$2,041,000 (or 62%) came from bottles of whisky, outpacing the value of the wine sales.

So, you want to collect whisky. What now?

Whether you simply enjoy a dram of single malt once in a while and want additional variety or are looking to amass an assortment of investment-grade whiskies, below are a few tips for how to start your collection.

Buy what you like.

Whisky is like wine in some respects. If you buy what you like to drink, even if your investment doesn’t pan out, you’ll still be able to enjoy your collection – by drinking it. Since whisky keeps longer than wine and will retain its same flavour over many years, if stored properly, there’s no need to rush into selling or drinking it either.

Then consider buying based on a theme.

Some people will collect whisky from a favorite distillery or a particular area of production, such as Islay. Others concentrate on keepsakes from specific points in history, as liquid souvenirs. Like any type of collectible, having a theme can make your collection more valuable.

Scarcity matters.

There were only nine bottles of the 1926 Macallan Fine & Rare whisky produced. When you can locate a bottle of it (which isn’t often), you could end up paying upwards of a quarter of a million dollars for it. Like any collectible, whisky that is truly rare will fetch a higher price than those that are available to everyone. That’s one reason why you may want to visit distilleries and look for limited editions or search out bottles from “lost” or “silent” distilleries – those that have closed down and are no longer producing.

Check out the auctions.

It’s important to do your homework before investing in whisky. You can head to duty-free shops, your local liquor shop or consider joining a high end club that provides exclusive tastings. A growing number of online whisky auctions may also be a good place to do research and start buying.

Understand how to store it properly.

Compared to wine, whisky is easy to store, is more durable, and shouldn’t mature or spoil if handled properly. Store your bottles upright – not on their sides, as high strength alcohol can degrade the cork or transfer unpleasant flavours into the liquid. Keep the bottles away from strong sunlight and temperature fluctuations. You may want to store them in cartons or cases, to avoid ripping or scuffing the labels, which can add to the bottle’s value.

Make sure your collection is insured.

While your homeowner’s policy will cover your home and its contents, it wasn’t designed to fully cover your whisky collection. Consider a premium, accidental damage policy that will cover your whisky for damage, spoilage, or loss. The policy should cover your whisky anywhere in the world, whether at home or in transit and have no deductible.

This content is brought to you by Chubb Insurance Australia Limited (“Chubb”) as a convenience to readers and is not intended to constitute advice (professional or otherwise) or recommendations upon which a reader may rely. Any references to insurance cover are general in nature only and may not suit your particular circumstances. Chubb does not take into account your personal objectives, financial situation or needs and any insurance cover referred to is subject to the terms, conditions and exclusions set out in the relevant policy wording. Please obtain and read carefully the relevant insurance policy before deciding to acquire any insurance product. A policy wording can be obtained at www.chubb.com/au, through your broker or by contacting any of the Chubb offices. Chubb makes no warranty or guarantee about the accuracy, completeness, or adequacy of the content. Readers relying on any content do so at their own risk. It is the responsibility of the reader to evaluate the quality and accuracy of the content. Reference in this content (if any) to any specific commercial product, process, or service, and links from this content to other third party websites, do not constitute or imply an endorsement or recommendation by Chubb and shall not be used for advertising or service/product endorsement purposes. ©2020 Chubb Insurance Australia Limited ABN: 23 001 642 020 AFSL: 239687. Chubb®, its logos, and Chubb.Insured.SM are protected trademarks of Chubb.

Tips & Resources

We help you stay ahead and informed with these helpful tips and tricks