Insurance for Life Sciences Companies

Who we serve

Chubb has deep expertise across the spectrum of life sciences companies and their activities from start-ups to the world’s largest companies

-

Pharmaceutical and Biotech Companies

From start-up firms with a single promising compound to clients bringing multiple drug targets through global clinical trials, you can count on our products, services and financial strength throughout your company’s life cycle.

Learn More -

Site Management Organizations and Contract Research Organizations

One policy form with three coverage parts enables customized coverage with one insurance carrier. When trying to bring a new drug or device to market, a site management company or contract research organization needs flexible coverage to manage exposures.

Learn More -

Clinical Trials Insurance

Chubb’s global network and Life Sciences expertise uniquely qualify us to help you coordinate your clinical trial insurance programs, helping to avoid costly delays.

Learn More -

Dietary Supplement Companies

As consumers have become more conscious of their health and well-being, your industry has expanded to meet the growing demand for dietary supplements. We provide specialized property and casualty insurance solutions to well-managed companies in this segment.

Learn More -

Life Sciences Services Organizations

Outsourcing has led to rapid growth in your industry. You face a full range of regulatory compliance, product liability and financial injury concerns. Our innovative errors or omissions insurance, along with our other industry-leading solutions offer the tailored protection you need.

Learn More -

Medical Device Companies

Rapid technological advances, emerging litigation risks, a global marketplace and increasing demand for your products keep your risks in constant flux. Our innovative all-lines solution and leadership in risk engineering and claims help us serve your unique needs.

Learn More

Products and Services

From supply chain disruptions to the constant search for breakthrough innovations, life sciences companies face scrutiny, pressure, and ever-changing liability risks. Chubb supports our over 6,000 life sciences clients in their ground-breaking and life-saving work with our specialized and dedicated life sciences practice team.

Meet our Life Sciences Industry Practice Leader

Lee Farrow | EVP, Life Sciences Industry Practice Leader

“We pride ourselves on being ready with products and solutions that meet the emerging needs of these companies as they pursue scientific breakthroughs.”

Case Studies

A fast-growing pharmaceutical company needed a partner who understands the complex risks involved in running clinical trials in different countries. Through WORLDcert™, our state-of-the-art interactive clinical trial insurance and certificate management system, we were able to build an integrated solution to meet their needs and render it easier to secure insurance certificates for various sites in the different countries.

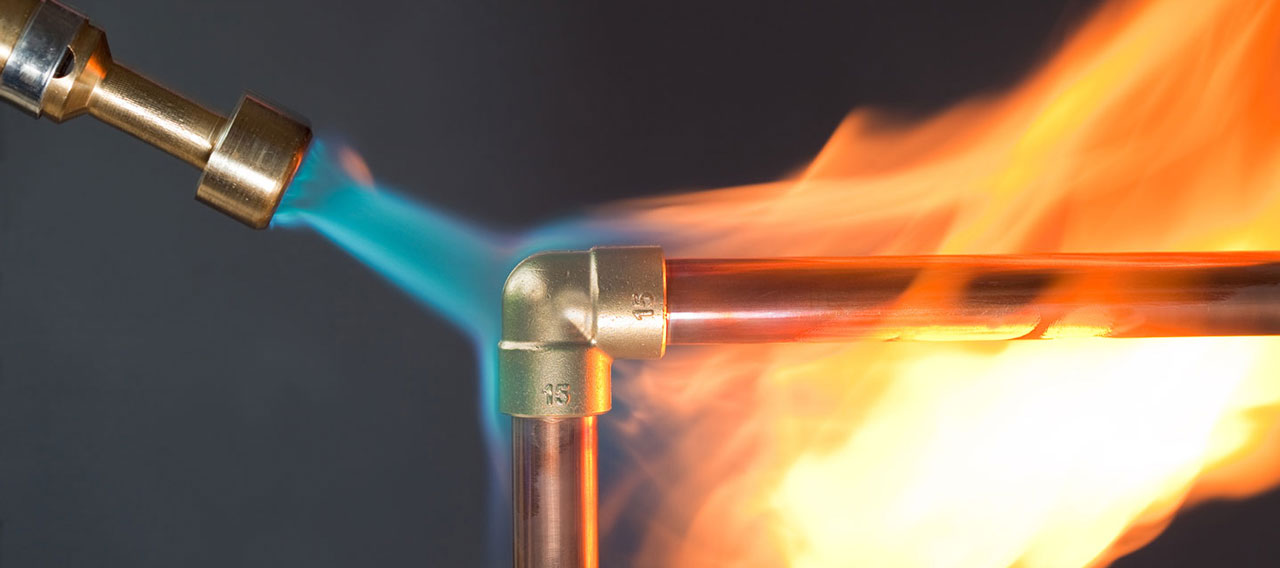

This manufacturer makes a complex product, so they wanted coverage that included product recall insurance with products and completed operations, general and property liability, and sophisticated risk engineering services to address their property exposures. We paired a range of insurance products with risk mitigation services to address all their needs.

Top of this client’s concerns were data privacy and security, and they wanted a partner who really understands the nature of cyber risk. We put together coverage that included the ability to conduct cyber risk assessments and provide online cyber education for their staff. In addition, they required healthcare coverage, products liability and Errors & Omissions (E&O) coverage.

FAQ

Our package policies include contingent business income coverage that indemnifies your company in the event of a loss from a covered peril to property of third party suppliers that disrupts the supply chain. We will help you to evaluate your contingent business interruption limits needs carefully by providing a basic business income calculator. For larger, more complex organizations we can assign you a business income consultant to determine what you need.

Perishable property is often the most critical asset of a life sciences company, so we understand that any malfunction or loss of power to refrigerators or freezers, or any introduction of contaminants, can be devastating. Our property policy includes all-risk ‘change in controlled environment’ insurance for spoilage of perishable property at owned locations, and in transit. It also covers contamination from bacteria, mold, mildew, viruses, microorganisms, pathogens, radiation, or airborne microbes.

In addition, we take a proactive approach to risks of spoilage and contamination, helping clients develop loss control recommendations.

We can review clients' third party contracts from a risk management perspective to help the clients and their attorneys identify potential liability risks that may be presented. We can work with clients' insurance agents and brokers to help ensure they appreciate these risks as they advise their clients on applicable insurance solutions.

Resources

Chubb’s Life Sciences Industry Practice (LSIP) has been a market leader for over 25 years. With over 100 dedicated and trained P&C Underwriters, Claims Professionals and Risk Engineers — we have the experience and specialized knowledge our clients, brokers and agents depend on.

Discover emerging risks and evolving trends in the middle market by delving into our comprehensive reports—based on a survey of 1,000 middle market firms.

Using Internet of Things (IoT) water sensors to reduce or eliminate the damage a water leak can cause.

We have the appetite, specialized expertise, insurance products, and services to help agents like you write more business and help protect your clients’ operations.

We have the underwriting appetite, specialized expertise, insurance products, and services to help agents like you quickly write more business for clients of all sizes.

Insights and expertise